It’s possible and it depends on YOU; how much of importance you place on improving your financial health.

Good, Average or Bad – Why Does It Matter?

Think of your credit score like a grade or score which you receive from school to earn your place into the best colleges or universities. This grade however, is more like a ‘grown-up score’ that you receive from performing well as an adult in your life.

Better credit scores could help you qualify for lower interest rates, attain a student loan or apply for a credit card. Having a poor credit score or an average one may hinder your chances of obtaining credit facilities from lenders.

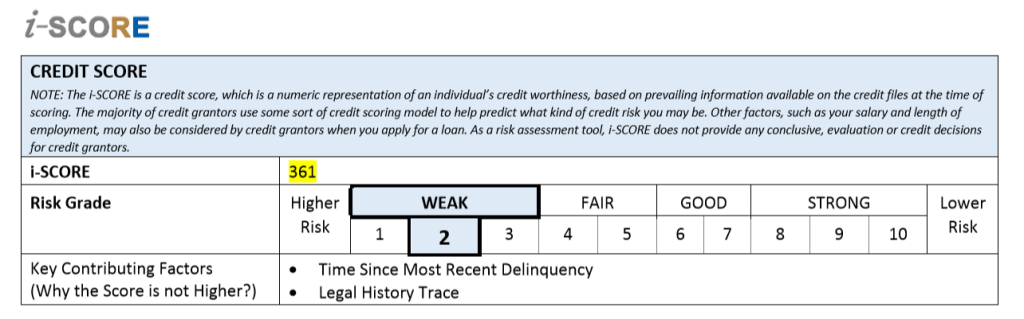

Generally, the higher the score (700 and above) means you are solidly good in credit and conversely, a low score (below 460) is indicative of poor credit.

If your score falls under the 35% of Fair – Weak category, then perhaps it’s time to rethink how to step-up your credit rating so that you are on par with the other 65% of Good – Excellent scoring Malaysians.

Trending in 2019

Thanks to on-going efforts by the government and credit reporting agencies in education and awareness, credit score is gaining traction among many quarters and is fast becoming a vital point of reference.

Speaking of emerging trends, many developers, landlords and employers are turning to credit score to access how much of a risk you are or, even determine your credibility as a person.

Typically, credit scoring is used to assess the risk for loan eligibility from banks and lenders. As new trends are shaping the landscape today, here are others ways in which a credit score is used by other sectors:

- Landlords are moving towards using credit scores to determine if you are reliable enough to lease their property to and can pay your monthly rental on time.

- Property developers (affordable housing market) are turning to credit and loan-scoring to review an individual’s loan potential so as to enhance the efficiency of the balloting process.

- Employers use credit reports as a form of employment screening to judge how responsible and financially stable you are. If your report isn’t top-notch or above average, then it may jeopardise your chances of clinching that job.

Gaining Control – Personal Credit Report PLUS

If you find that your credit score isn’t up to mark and more can be done, don’t worry! There are ways to improve it. A good start would be to gain access to a credit report to understand where your shortfalls are and how lenders use it. Experian’s Personal Credit Report (PCRP) is an example of a credit management tool that enables you to take control of your finances.

As a one-stop tool, PCRP provides credit information on:

- Experian i-SCORE (credit score)

- Banking information (CCRIS)

- Skim Potongan Gaji Angkasa (SPGA)

- PTPTN

- Trade references (non-banking info)

- Litigation history and more..

Bottom Line

Credit scoring is inevitably becoming a broader concept than just a tool for lending services. The way it spills into personal dimensions and other realms increases its relevance for users today.

Knowing your credit score and looking at where you stand on an average level is all about financial responsibility. Research suggests that individuals who check their scores frequently manage their credit better and are more likely to have high scores.